Introduction

For many private companies, a merger or an acquisition may be the perfect move to take their company to the next level. Market participants need a solid understanding of the total consideration paid and received in a transaction. When equity is part of the consideration, the buyer needs to identify the accurate value of that equity to avoid overbidding for the target company. The seller needs to identify the accurate value of the equity being received. In order to ensure the best deal possible, both the buyer and seller should perform a careful analysis of the purchase consideration and its contingencies.

Equity transactions are more complex than all cash transactions. Unlike cash, the value of equity can be subjective and is dependent upon the future performance of the post-transaction entity. The makeup of the consideration paid in a transaction will determine the amount of subjectivity that exists in the specified value.

In addition to the subjectivity found in an equity transaction, buyers and sellers should consider the different economic rights held by each class of equity included in a transaction. Given that economic rights included in the transaction often differ from one class of equity to the next, in most cases it would be inaccurate to assume that all classes of equity have the same value.

Subjectivity

Unlike cash consideration, the value of equity consideration is not fixed; the true value of equity depends on the future performance of the post-transaction entity. Equity consideration carries greater risk as well as greater upside opportunity for the seller because it allows the seller to participate in the success or failure of the company going forward.

Equity consideration can incentivize the seller to help grow the company after the transaction. Employees with stock in a company will be more inclined to stay and work hard to make the transaction a success.

Makeup of the Consideration

The makeup of the consideration used in a transaction has a significant impact on the amount of risk assumed by the seller in a transaction. Specifically, the terms associated with the equity received, such as antidilution provisions and sell restrictions, can increase the seller’s exposure to an unsuccessful merger. Similarly, the buyer can reduce risk by not attaching antidilution provisions and by enforcing sell restrictions on the equity used to pay the seller.

An antidilution provision most often affects the conversion ratio associated with a class of equity in the event equity is ever issued by the company at a lower valuation. For example, assume the original share price on a class of preferred equity is $1.00 and that the company issues shares at $0.50 per share in the future. The ratio tied to the conversion of preferred to common equity could move from 1x to 2x. Instead of converting to common at $1.00 per share ($1.00/$1.00 = 1x), preferred equity would now convert at the lower $0.50 share value ($1.00/$0.50 = 2x). This would protect the seller in the event the entity, over which they now have little control, performs poorly in the future and subsequently issues equity at a lower valuation.

The conversion ratio will either be fixed or floating. A fixed ratio increases the seller’s risk because it locks in the ratio. If the value of the acquiring entity were to crash within the date the ratio was locked and the date of the transaction, the seller’s value would be significantly diminished. A floating ratio is flexible and adjusts the ratio to the overall value agreed upon by the buyer and seller.

The buyer needs to be careful when negotiating potential antidilution provisions because something like an aggressive conversion ratio can further dilute their position in the event the company performs poorly and needs to issue equity at a lower valuation in the future. In certain circumstances, an antidilution provision that is held by one share class and not another can potentially lead to significant negative outcomes.

Additionally, the sell restrictions agreed upon in the transaction can increase the seller’s risk by limiting their ability to liquidate. Sell restrictions are meant to protect the acquiring company by preventing a quick sell-off that would negatively impact the value of the entity. These restrictions prevent the sellers from liquidating their equity for a given period. The longer the period, the greater the seller’s exposure to an unsuccessful merger. If the value of the combined entity were to deteriorate before the seller could liquidate, the seller would lose value.

Class of Equity

Private companies often have many different classes of equity. Each class of equity can have different economic rights that impact the value of the other securities. When considering a transaction, buyers and sellers should determine what classes of equity are involved and whether a certain class of equity is driving the valuation.

For example, when contemplating a transaction, many professionals consider what is known as the post-money valuation. The post-money valuation refers to the price per share paid in the most recent round of financing multiplied by the company’s fully diluted share count. This metric can serve as a relevant benchmark for the value of a company. However, the post-money value often overstates the actual value of the company because different shares have different economic rights. The difference in economic rights dictates that the shares are not the same and should not carry the same value.

The price paid in the most recent round of financing is based on the economic rights associated with the shares sold in that round. These shares generally have seniority, dividends, participation rights, antidilution provisions, a larger liquidation preference, and other rights that are extremely valuable. While many of these rights are more valuable in early-stage or nonprofitable businesses, they should always be considered, because depending on the structure, there may be a significant difference in value between share classes due to these rights.

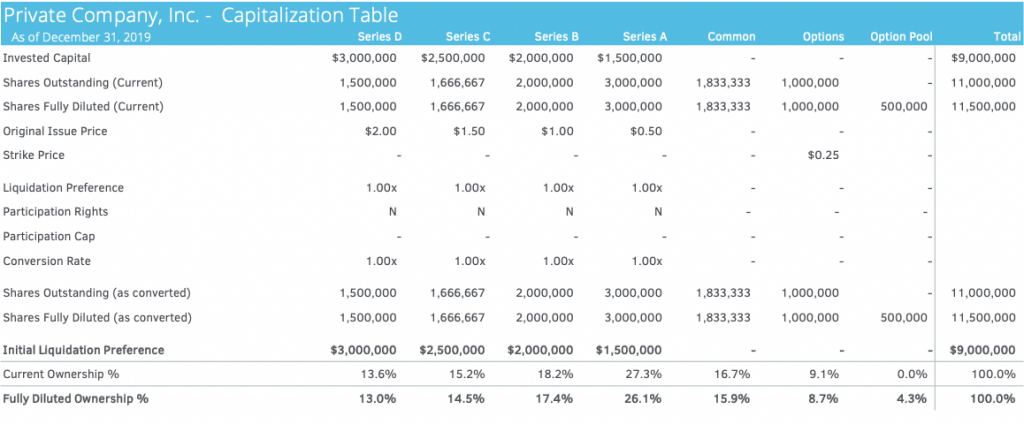

Consider this simple capitalization structure.

The post-money valuation for this company would be $23M, the 11.5M fully diluted share count multiplied by the $2.00 Series D purchase price.

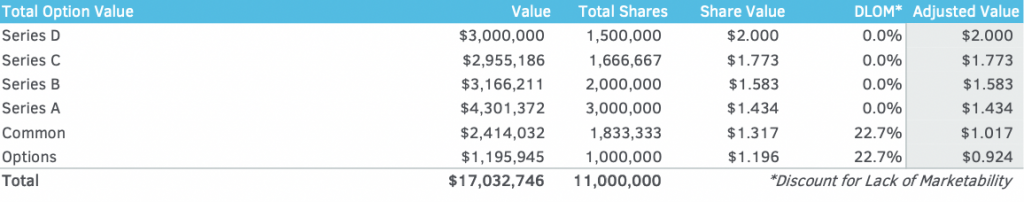

Using an allocation model such as the Option Pricing Method (OPM), a valuation specialist can solve to the price per share paid for the last round of financing and then determine the value of each share class based on that valuation. Assuming 5-year maturity and 50% volatility, if the Series D investment for the capitalization displayed above closed on June 30, 2019, and each round of preferred had equal seniority, the OPM would assign the following values to each share class:

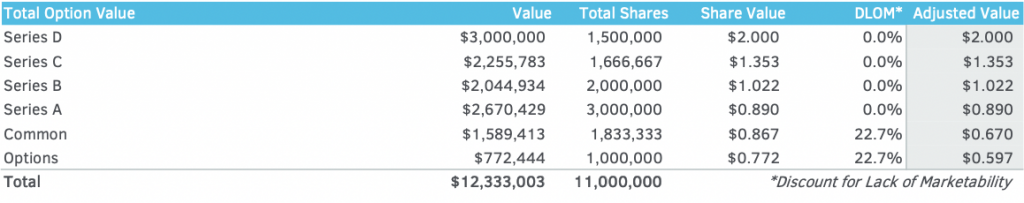

As displayed in the table above, the implied value of the company based on the most recent round is $17M, significantly less than the post-money valuation of $23M. To further illustrate the impact of economic rights, the following table displays the value of each share class with the same capitalization when each round.

Changing the seniority depletes the value of the company even further. The seniority of the more recent rounds sucks the value from the junior preferred and common. A similar effect would occur if the preferred classes received cumulative dividends, a larger liquidation preference, or had a larger conversion rate or had participation rights on top of their liquidation preferences.

If the acquiring company is private, buyers and sellers need to understand the value of each individual share class when negotiating the terms of the equity exchange. If the acquiring company has a $23M post-money valuation and they are the exchanging common shares for equity in the target company, those common shares may be worth significantly less than the Series D preferred shares driving the post-money valuation. The post-money valuation likely overstates the value of junior preferred and common. A seller receiving these shares at a valuation implied by a recent post-money value is likely receiving quite a bit less than they think they are receiving.

Sellers should have a keen understanding of the value of each share class, particularly the equity they will receive in exchange for their ownership in the target company. Buyers need to be aware of how the exchanged equity will impact their position in the post-transaction entity.

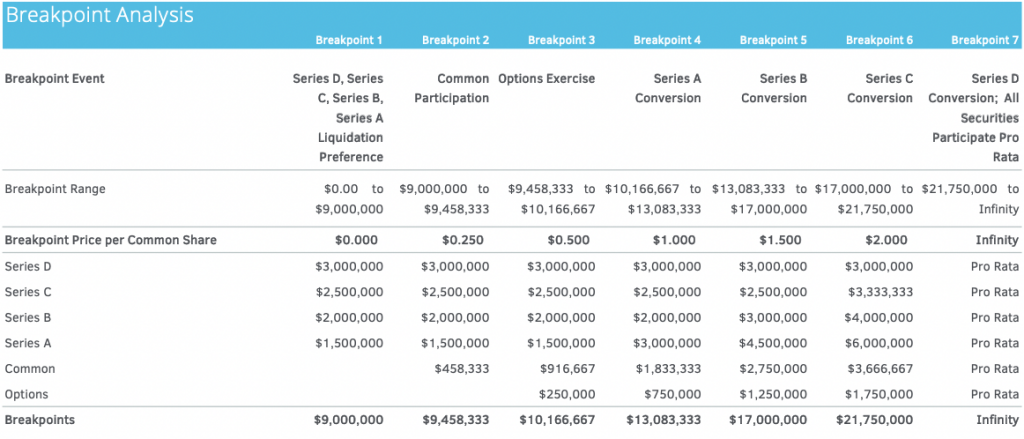

In order to better understand the impact of the economic rights for each individual share class, buyers and sellers should carefully analyze the company’s breakpoints. A breakpoint is created each time the economics of the distribution of proceeds changes. The breakpoint analysis below is based on the capitalization table from the previous example and demonstrates how proceeds would be allocated to each share class at the different breakpoint values.

The first breakpoint represents the liquidation preference for each share class. Prior to this breakpoint, any proceeds from a transaction or liquidation event would be divided pro rata among the four preferred share classes. The second breakpoint represents common’s participation after the preferred liquidation preference is met. The third breakpoint captures the value at which the option holders will exercise. The remaining breakpoints represent the values where each preferred class will convert to common. After Series D converts, all share classes participate pro rata as common shareholders.

While the acquiring company should be aware of how a merger or acquisition will affect the capitalization and breakpoints, the target company should ensure the value of the shares they are receiving accurately considers any economic disadvantages demonstrated by the breakpoint analysis that is calculated from the post-transaction cap table.

The seller should also consider the breakpoint analysis of its own cap table prior to the transaction. For example, if the breakpoints displayed above belonged to the target company, the ideal sale price would exceed $21.75M in order to ensure all investors receive a return on their investment. Selling short of $21.75M would result in Series D receiving only $2.00 per share, which would only equal the price that those investors originally paid.

Conclusion

Stock mergers and acquisitions occur frequently in the private sector, and market participants should be aware of key nuances that will affect the outcome of the transaction. Both buyers and sellers should work to understand the true value of any equity consideration included in the deal.